Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Tools like our free ProfitWell Metrics make it easy to keep track of KPIs like that one.

Having a clear returns policy and making the process fast and easy for the customer is essential. To break this down even further, we can walk through some examples. As you can see from the calculator above, calculating cost per unit includes a few main components. In this article, we will define cost per unit, explain why it is important, show how to calculate it, and offer actionable tips to reduce your cost per unit. By contrast, the ”process cost center is a cost center which consists of a continuous sequence of operations.” According to the Institute of Cost and Management Accountants, the ”operation cost center is a center which consists of those machines and/or persons which carry out the same operations.”

Examples of unit cost

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

To do that, you need to have some idea of how much capital you will have in the future. Combing unit economics with your acquisition rate will give you an idea of how much your company will be bringing in and aid with financial planning. In the early stages of a business, unit economics are an even more important factor in determining how much you can spend on acquisition and how much you can expect to get in return. They are a great predictor of the long-term financial health of your business model. If you have a large business make a purchase with your company, they are likely to purchase several subscriptions. They have a large number of employees who need to use your software.

Examples of Unit Costs in a sentence

For the units-as-products-sold model, the above scenario flips. For a SaaS business, that would mean each subscription is counted as one unit. For physical products — where there are production costs per item to account for — units as products sold is more standard.

Here is how ShipBob can turn your logistics operations into a revenue driver. “Overall, there is more transparency with ShipBob that even helps our team manage customer service better. I can see the granular stage the order is in — if it’s being picked, packed, in transit, etc.

How do you calculate unit economics?

Product is anything, any item, or any value that the company offers to the customer. The company offers the product in the form of goods or services to the customer by charging a certain sum of money that includes the cost and profit margin. A production cost center refers to a cost center that is engaged in regular production (e.g. converting raw materials into finished products). An impersonal cost center refers to a cost center that consists of a location, item of equipment, or a group of these (e.g., machines, departments, and vehicles). A production cost center refers to a cost center that is engaged in regular production (e.g., converting raw materials into finished products).

Unit contribution margin is important for managers to understand because it is used in order to calculate contribution margin ratio of products as well as break-even point analyzes. While you can always try to get customers to spend more (or you can charge them more money), the root cause of low margins is often high costs for the business. By keeping the cost per unit low, you can pass on the savings to the customer and entice more customers to buy (or take home more money if you’re able to sell it at a premium). For Greg and many other retail businesses, success is heavily reliant on having a profitable cost per unit — and half of that battle is keeping your costs low.

- What unit economics is tracking is how much it costs you to acquire a customer compared to what they bring in.

- This measure of the quantity of a product or service is known as the cost unit.

- Since variable costs are usually easy to track back to units being produced, variable costs can be estimated for each product produced.

- We can create ShipBob WROs directly in Inventory Planner and have the inventory levels be reflected in our local shipping warehouse and ShipBob immediately.

He is the sole author of all the materials on AccountingCoach.com. Unit economics is a useful measuring stick for changes you may make to your marketing strategy or budget, pricing model, or any other changes that may affect sales or churn rates. If the LTV to CAC ratio changes unfavorably, you might want to rethink the decision.

What is unit price?

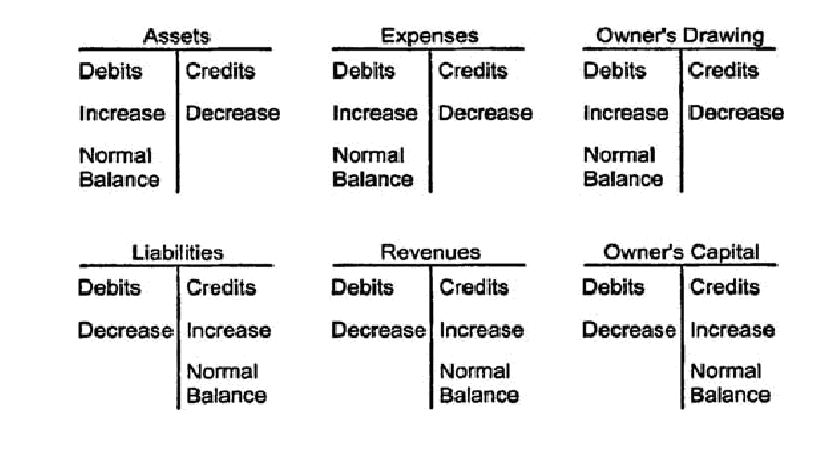

Unit economics are the direct revenues and costs of a particular business measured on a per-unit basis, where a unit can be any quantifiable item that brings value to the business. Calculating unit economics makes it easier to forecast things such as break-even points and gross margins. Most businesses are probably, at least on some level, using unit economics calculations even if they are not familiar with the term. But fully taking advantage of your unit economics requires a little more commitment and understanding. Unit contribution margin measures the amount of the selling price of a unit that is used to cover fixed costs for that unit. Since companies’ cost structures are important for production and planning purposes, managers want to know how much fixed costs are distributed to each unit produced.

Black Mammoth Metals Arranges $100,000 Private Placement – Yahoo Finance

Black Mammoth Metals Arranges $100,000 Private Placement.

Posted: Tue, 08 Aug 2023 23:49:00 GMT [source]

In February 2022, the variable cost incurred was $3,000, which includes raw materials, electricity, and labor. Calculating cost per unit is also important, because it gives ecommerce companies an idea of how much they should charge for each of their products to be profitable. A low per-unit cost is an indicator of efficient production and logistics, which ensures profit is being made per sale. Of course, quality plays a role, as higher quality or premium goods typically cost more to produce than less durable or cheaper materials. Companies consider a variety of factors when determining the market offering price of a unit.

Academic Research for Unit Variable Cost

Customer lifetime value is the average amount of money that you earn per customer over the lifetime of their relationship with you. In SaaS, this is the amount of money you make from the time they sign up, to the time they cancel and don’t return. Calculating LTV accurately can tell you a lot about your business. For US shipments, for example, ShipBob offers faster, affordable 2-day shipping options for qualified customers to meet customer expectations around fast shipping while also reducing shipping costs. As far as returns go, 92% of shoppers say they will buy again if the returns process was easy and overall positive. To offset the costs of a return, focus on increasing exchanges.

- Of course, quality plays a role, as higher quality or premium goods typically cost more to produce than less durable or cheaper materials.

- Since companies’ cost structures are important for production and planning purposes, managers want to know how much fixed costs are distributed to each unit produced.

- A cost unit may be expressed in terms of number, length, area, weight, volume, time, or value.

- Unit economics is a useful measuring stick for changes you may make to your marketing strategy or budget, pricing model, or any other changes that may affect sales or churn rates.

For instance, an auto manufacturer can could the labor hours and materials used to produce a fender on a car. But to accurately calculate cost per unit, it’s important to understand what is considered fixed costs versus variable costs. Private and public companies account for unit costs on their financial reporting statements. All public companies use the generally accepted accounting principles (GAAP) accrual method of reporting.

Factors for Selecting a Suitable and Effective Cost Center

For a SaaS business, it makes sense to count a company, and all of the subscriptions they have, as one unit. You can, however, count individual subscriptions as a unit if that makes sense for your company. Once you have your unit, calculate how much the lifetime revenue for that unit is, and divide it by your CAC to get the basic economics of that unit. It cost unit is defined as is a better practice, however, to use the predictive LTV or flexible LTV values, given above, when calculating your unit economics. Before we can tell you how to calculate your unit economics, you need to understand the metrics that go into the calculation. There are many ways to measure the success of a business and to predict its financial stability.

Some companies may have a high amount of indirect costs which requires higher pricing to more broadly cover all of the company’s expenses. The unit cost, also known as the breakeven point, is the minimum price at which a company must sell the product to avoid losses. As an example, a product with a breakeven unit cost of $10 per unit must sell for above that price. It defined a cost center a location, person, or item of equipment (or a group of these) for which costs may be ascertained and used for the purposes of cost control. A cost unit is defined as ”a unit of quantity of product, service, or time (or a combination of these) in relation to which costs may be ascertained or expressed.” When a plant or machine is taken as a unit, it is an impersonal cost center; when a person or group of persons are taken as a unit, the personal cost center is implied.